Does Cigna Cover weight loss surgery?

Cigna, a leading health insurance provider, has become increasingly popular for its extensive coverage options. As health and wellness take center stage in our lives, many individuals are seeking answers regarding coverage for bariatric surgery – a potential life-changing procedure for weight loss. In this article, we explore the question on everyone’s mind: “Does Cigna cover bariatric weight loss surgery?” As we delve into the details and intricacies of Cigna’s coverage policies, we hope to provide you with valuable insight into this matter.

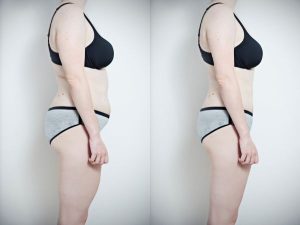

This image is property of images.pexels.com.

Does Cigna Cover Weight Loss Bariatric Surgery?

Coverage for Bariatric Surgery

If you’re considering bariatric surgery as a weight loss solution, you may be wondering if Cigna, your health insurance provider, covers this procedure. We’re here to provide you with all the information you need to know about the coverage for bariatric surgery offered by Cigna.

Eligibility Criteria for Does Cigna Cover weight loss surgery

Cigna has certain eligibility criteria that need to be met in order to be considered for coverage for bariatric surgery. These criteria typically include Body Mass Index (BMI) requirements, co-morbidity requirements, and evidence of previous weight loss attempts. It’s important to consult with your healthcare professional or Cigna representative to determine if you meet the eligibility criteria.

Required Documentation

To support your claim for coverage for bariatric surgery, Cigna requires specific documentation. This documentation may include a letter of medical necessity, documentation of failed non-surgical treatments, a psychological evaluation, nutritional counseling records, and a risk assessment and evaluation. It’s crucial to gather all necessary documents to ensure a smooth pre-authorization process.

Pre-authorization Process

Obtaining pre-authorization from Cigna is a crucial step before proceeding with bariatric surgery. Pre-authorization is the approval from your health insurance provider that validates your eligibility for coverage. To begin the process, it’s important to understand the importance of pre-authorization, the steps involved, the timeframe for pre-authorization, and the steps to take if your pre-authorization is denied.

Types of Bariatric Surgery Covered

Does Cigna cover weight loss various types of bariatric surgery, each with its own unique approach and considerations. It’s essential to understand the differences between these types and their eligibility requirements before making a decision. The types of bariatric surgery covered by Cigna may include laparoscopic sleeve gastrectomy, Roux-en-Y gastric bypass, adjustable gastric banding, biliopancreatic diversion with duodenal switch, and gastric balloon procedures.

Coverage for Roux-en-Y Gastric Bypass

Another type of bariatric surgery covered by Cigna is Roux-en-Y gastric bypass. This procedure involves creating a small pouch at the top of the stomach and bypassing a portion of the small intestine. Similar to other types of bariatric surgery, specific eligibility criteria need to be met to qualify for coverage. It’s also important to understand the average cost and coverage percentage for Roux-en-Y gastric bypass.

Coverage for Adjustable Gastric Banding

Cigna also provides coverage for adjustable gastric banding, a procedure that involves placing a band around the upper part of the stomach, creating a smaller pouch. This restricts the amount of food that can be consumed, leading to weight loss. Meeting the eligibility criteria is essential to qualify for coverage, and ongoing adjustments are important for maximizing the effectiveness of this procedure.

This image is property of images.pexels.com.

Inclusions and Exclusions

While Cigna covers bariatric surgery, it’s important to be aware of the inclusions and exclusions within their coverage. Understanding the fine print will help you navigate the coverage limitations and make informed decisions related to your weight loss journey.

Coverage for Medical Necessity

Cigna provides coverage for bariatric surgery based on medical necessity. This means that individuals with documented medical conditions related to obesity may be eligible for coverage. It’s important to consult with your healthcare professional to determine if your specific situation qualifies as medically necessary.

Coverage Limitations

Like any other insurance coverage, Cigna’s coverage for bariatric surgery also has certain limitations. These limitations may include restrictions on the number of procedures covered, waiting periods, and specific medical criteria that must be met. Familiarizing yourself with these limitations will help you plan accordingly and set realistic expectations.

Co-morbidity Requirements

Cigna also has co-morbidity requirements for individuals seeking coverage for bariatric surgery. Co-morbidities are additional health conditions that commonly occur alongside obesity, such as high blood pressure, type 2 diabetes, or sleep apnea. Meeting these co-morbidity requirements may be necessary to qualify for coverage.

Previous Weight Loss Attempts

In some cases, Cigna may require documentation of previous weight loss attempts as part of their eligibility criteria. This may include evidence of participation in weight loss programs or medically supervised diets. Demonstrating a history of attempting to lose weight through non-surgical means can support your claim for coverage for bariatric surgery.

Documentation of Failed Non-surgical Treatments

Cigna may require documentation of failed non-surgical weight loss treatments as part of their pre-authorization process. This documentation can include records of participation in weight loss programs, medically supervised diets, or evidence that other non-surgical interventions have been ineffective in achieving sustainable weight loss.

Psychological Evaluation

To ensure the safety and overall success of the bariatric surgery, Cigna may require a psychological evaluation. This evaluation aims to assess your mental and emotional readiness for the procedure and the potential lifestyle changes that follow. It’s important to prepare for this evaluation to ensure all requirements are met.

Nutritional Counseling

Nutritional counseling is another requirement that may need to be fulfilled before being approved for coverage for bariatric surgery. This counseling provides education and guidance on proper nutrition and dietary changes that will be essential after the procedure. Adhering to these counseling sessions demonstrates your commitment to a healthy and sustainable lifestyle.

Risk Assessment and Evaluation

Cigna may conduct a risk assessment and evaluation to better understand the potential risks and benefits of bariatric surgery in your specific case. This assessment may involve tests, consultations, and examinations to ensure that you are in optimal health for the procedure. It is important to cooperate fully with this assessment to ensure a safe and successful experience.

Importance of Pre-authorization

Obtaining pre-authorization from Cigna is crucial before proceeding with any bariatric surgery. Pre-authorization ensures that you meet the eligibility criteria and that the procedure is deemed medically necessary. Without pre-authorization, you may be responsible for the entire cost of the surgery.

Steps to Obtain Pre-authorization

The process of obtaining pre-authorization for bariatric surgery requires several steps. It’s crucial to familiarize yourself with these steps and ensure that you have all the required documentation ready before starting the process. This will help streamline the pre-authorization process and avoid any potential delays.

Timeframe for Pre-authorization

The timeframe for pre-authorization may vary, and it’s important to be aware of the expected duration. It’s advisable to initiate the pre-authorization process well in advance to allow ample time for review and approval. This will ensure that you can proceed with the surgery within your desired timeframe.

Appealing a Denied Pre-authorization

In some cases, pre-authorization for bariatric surgery may be denied by Cigna. If this occurs, it’s important not to lose hope. You have the right to appeal the decision and provide additional supporting documentation to strengthen your claim. It can be helpful to consult with your healthcare professional or a patient advocate to guide you through the appeals process.

Differences in Approaches

Bariatric surgery involves several different approaches, each with its own benefits and risks. It’s essential to understand these differences and consult with your healthcare professional to determine the most suitable approach for your specific situation. The more informed you are, the better equipped you will be to make a decision that aligns with your weight loss goals.

Eligibility for Each Type

Each type of bariatric surgery covered by Cigna may have specific eligibility criteria that must be met. These criteria can include age, BMI requirements, and evidence of co-morbidities. It’s crucial to consult with your healthcare professional or Cigna representative to determine which type of bariatric surgery you may be eligible for.

Benefits and Risks of Each Type

Understanding the benefits and risks associated with each type of bariatric surgery is essential when making a decision. Laparoscopic sleeve gastrectomy, Roux-en-Y gastric bypass, adjustable gastric banding, biliopancreatic diversion with duodenal switch, and gastric balloon procedures all have unique advantages and potential challenges. Consulting with your healthcare professional will help you weigh the benefits and risks to make an informed choice.

Criteria for Coverage

Each type of bariatric surgery covered by Cigna has specific criteria that must be met to qualify for coverage. These criteria can include medical necessity, BMI requirements, and other factors. It’s crucial to review the specific criteria for each procedure to determine if you are eligible for coverage.

Average Cost and Coverage Percentage

Bariatric surgery can be a significant financial investment. Understanding the average cost and coverage percentage for each type of procedure can help you plan and budget accordingly. It’s important to be aware of any out-of-pocket expenses you may be responsible for and to explore available financing options if needed.

Temporary vs. Permanent Balloon Options

For individuals considering gastric balloon procedures, it’s important to weigh the differences between temporary and permanent options. Temporary balloons are typically removed after a few months, while permanent balloons may require ongoing maintenance and monitoring. Understanding these distinctions will help you make an informed decision about the most suitable approach for your weight loss journey.

In conclusion, Cigna does offer cover for bariatric surgery for weight loss. Understanding the eligibility criteria, required documentation, pre-authorization process, types of surgery covered, and the specific coverage for each procedure is key to navigating through this journey successfully.